Advantages of Incorporating an LLC

In a state like Delaware or Wyoming

Do the owners of closely held LLCs and corporations enjoy more liability protection by incorporating in states like Delaware or Wyoming as opposed to incorporating in Florida? Except for single member LLCs the answer is "no".

- For corporations and muli-member LLCs the level of protection provided by Florida and Delaware (or Wyoming) are the same

- For single member LLCs there is an advantage to incorporating in a state like Delaware or Wyoming.

BUT

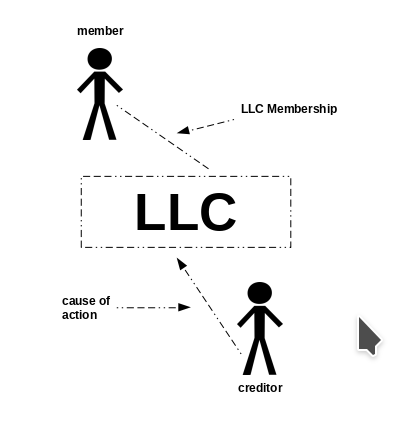

Protecting a Member from Creditors of the Company

- All LLCs incorporated in either Delaware/Wyoming and Florida provide the same level of protection from the most common type of liability, namely, where the debt is owed by the company and the creditor then tries to "pierce the corporate veil" by having the courts seize the personal assets of the company's owners (called "members"). The owners are equally protected in both kinds of states. . Their ownership is treated as if it were a partnership interest as opposed to being treated as if it were corporate stock.

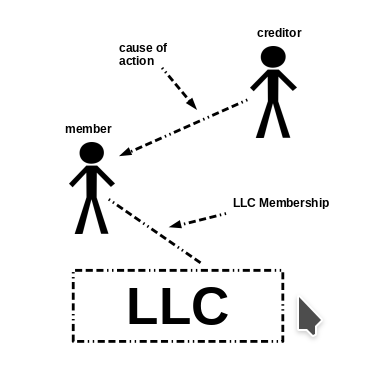

Protecting the Company from Creditors of a Member

- But what if the creditor gets a judgment NOT against the company BUT against the LLC's sole member on account of some personal debt that is owed. Would that creditor then be able to use the courts to seize that member's ownership interest in the LLC as if it were corporate stock? Doing that would allow the creditor to gain direct control of the LLC and its assets Delaware or Wyoming, in theory, provides slightly better protection with regard to single member LLCs.

-

MULTI-MEMBER LLCs

- In both Florida and Delaware/Wyoming the courts will not allow the seizure of a member's LLC membership interests when the LLC has multiple members. The sole remedy for the creditor would be to get the court to issue a "charging order" seizing any funds that might be distributed by the LLC to the member.

- The treatment of single member LLCs is different. Unlike Delaware or Wyoming, Florida treats membership interests in a single member LLC as if it were stock in a corporation. This means that it can be seized by the courts to satisfy the debt along with the other assets owned by the debtor.

SINGLE-MEMBER LLCs

INCORPORATING IN DELAWARE OR WYOMING

IS MORE EXPENSIVE THAN INCORPORATING IN FLORIDA

- You must to retain a Delaware (or Wyoming) law firm or a service provider to prepare and file the paperwork (some money might be saved by using a service like LegalZoom).

- You would also have to pay money to retain a firm in Delaware (or Wyoming) to act as the LLC's in-state "registered agent"

- You must pay an annual "franchise tax" to the State of Delaware ($300 per year plus hefty late fees and interest if not timely). Wyoming is somewhat less expensive than Delaware.

- If the Delaware (or Wyoming) LLC wanted to do business in Florida it would also have to separately pay to register as a "foreign" company with Florida and then pay Florida's annual fee thereafter ($138.75 per year)

SOLUTIONS

- Incorporate single member LLCs in a state like Wyoming or Delaware.

- People want their single member LLC to be incorporated in Florida while keeping sole control but still have the protection offered by the laws of states such as Wyoming and Delaware might try to make their Florida LLC appear to be a multi-member LLC while keeping most of the benefits of being the sole owner. This might involve bringing in a new member but only giving that new member a very small share of the owership rights & profits and perhaps no say in management.

- It is unclear if the Florida courts would respect an LLC that was structured as decribed in the previous paragraph. In a lawsuit filed by an aggressive creditor the courts might or might not consider the LLCs structure to be a sham and thus ignore it. The law is still relatively new and it is hard to predict what might happen if the issue was presented to a judge.

MORE INFORMATION

- Article about Wyoming LLCs - practical information about how to do it.